tennessee inheritance tax laws

We hope the following information provides some basic information about Tennessees inheritance and gift taxes. In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time.

Until that time estate administrators must continue to file the appropriate returns and pay the required estate taxes if the estate is larger than the amount of the exemption.

. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. A legal document is drawn and signed by the heir waiving rights to. Tennessee has updated its tax laws recently regarding both its inheritance tax and gift tax.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident. Section 32-1-104 two people must witness the wills signing and one must come to court to prove its validity or submit a sworn statement.

Tennessee Inheritance Law. Its paid by the estate and not the heirs although it could reduce the value of their inheritance. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

Application For Tennessee Inheritance Tax Waiver RV-F1400301 Step 2. In May 2012 legislation was enacted which will phase out the Tennessee inheritance tax by 2016. However there are additional tax returns that heirs and survivors must resolve for their deceased family members.

For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within the state of Tennessee and the gross estate exceeds 1250000. The Federal estate tax only affects02 of Estates. An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations.

Complete Edit or Print Tax Forms Instantly. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required. Tennessee Inheritance and Gift Tax.

With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a stress free and considerate process. A summary of how intestate succession laws work in Tennessee. Nolos Estate Planning Blog.

It is one of 38 states with no estate tax. Up to 25 cash back Tennessee Terminology. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of.

Posted on Jul 29 2013 826AM by Attorney Jason A. Be aware of that your assets located in other states may be subject to that localitys inheritance or estate tax. Final individual federal and state income tax returns.

Up to 25 cash back To inherit under Tennessees intestate succession statutes a person must outlive you by 120 hours. Our network attorneys have an average customer rating of 48 out of 5 stars. Ad Download Or Email TN INH 302 More Fillable Forms Try for Free Now.

The Federal inheritance tax exemption for 2014 was raised to 534000000 today. Holographic or handwritten wills are are also considered valid in the state. The inheritance and estate taxes wont be a concern of Tennessee residents who dont own or inherit the.

There is no federal inheritance tax but there is a federal estate tax. Each due by tax day of the year following the. The inheritance tax applies to money and assets after distribution to a persons heirs.

According to Tennessee Code Ann. IT-12 - Inheritance Tax Deduction - Real Property Sale Expenses. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million.

IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident. There is no obligation. Tennessee is an inheritance tax-free state.

The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses. So if you and your brother are in a car accident and he dies a few hours after you do his estate would not receive any of your property. IT-11 - Inheritance Tax Deductions.

2 An estate tax is a tax on the value of the decedents property. Tennessee Inheritance Tax Is jointly held property considered part of the decedents taxable estate under Tennessee law. Give the complete name of the person whose estate is in question and the county in which they lived as well their date of death and Social Security number.

Application For Tennessee Inheritance Tax Waiver RV-F1400301 Step 1. IT-1 - Inheritance Tax Repealed. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

As mentioned previously the probate process in Tennessee typically takes anywhere from eight months to three years to. Next year it will increase to 500000000 and then it will be abolished in 2016. All inheritance are exempt in the State of Tennessee.

An inheritance tax is a tax on the property you receive from the decedent. Info about Tennessee probate courts Tennessee estate taxes Tennessee death tax. Tennessee Code Ann.

For example the state of Tennessee does not follow strict community property inheritance laws which means you must be careful when it comes to creating an estate plan. It allows every Tennessee resident to reduce the taxable part of their estate gifting it away to the heirs 16000 per person every year. Ad Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now.

Was this article helpful. Gift and Generation-Skipping Transfer Tax Return. Inheritance Tax in Tennessee.

Under Tennessee law jointly held property can be considered part of the deceased individuals taxable estate. There are NO Tennessee Inheritance Tax. Does Tennessee Have an Inheritance Tax or Estate tax.

As you plan for your financial future and its a good. Proving the Wills Validity. Question one asks whether a representative for the.

February 26 2021 1036. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. 31-3-120 Half-relatives.

The possibility of the government taxing your hard-earned money after your death is a valid concern. There is no inheritance tax in Tennessee this would be tax that falls on the heirs and. What Tennessee called an inheritance tax was really a state estate tax that is a tax imposed only when the total value of an estate exceeds a certain value.

Tennessee and Federal Estate Tax Exemptions Raised Today for 2014. If someone contests the will both witness must prove its validity. Tennessee does not have an estate tax.

The inheritance tax is paid. Also in this case you need to file Form 709. In 2016 the inheritance tax will be completely repealed.

The inheritance tax is repealed for dates of death in 2016 and after. There is a chance though that another states inheritance tax will apply if you inherit something from someone. Those who handle your estate following your death though do have some other tax returns to take care of such as.

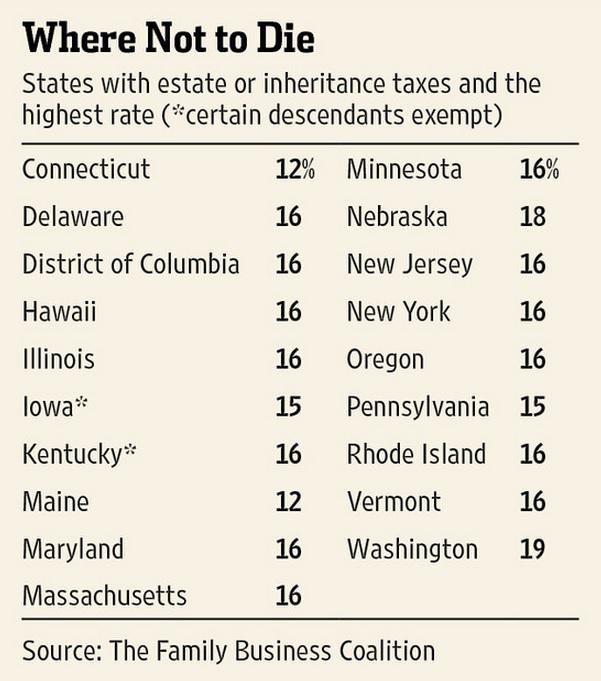

Ad Access Tax Forms. Even though Tennessee does not have an inheritance tax other states do. Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000.

Details on Tennessees. Tennessee is an inheritance tax and estate tax-free state. 0 out of 0 found this helpful.

The inheritance tax is different from the estate tax. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. Inheritance Law By Zipcode author Attorney Liza Hanks is also author of Nolos Estate Planning Blog.

As well as how to collect life insurance pay on death accounts and survivors benefits and fast Tennessee probate for small estates. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Summary of Tennessees Intestate Succession Laws.

Tennessee does not have an inheritance tax either.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The Death Tax Taxes On Death American Legislative Exchange Council

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Death And Taxes Nebraska S Inheritance Tax

Are You Exposed To The New Jersey Estate Tax New Jersey Jersey Diploma Design

State Estate And Inheritance Taxes Itep

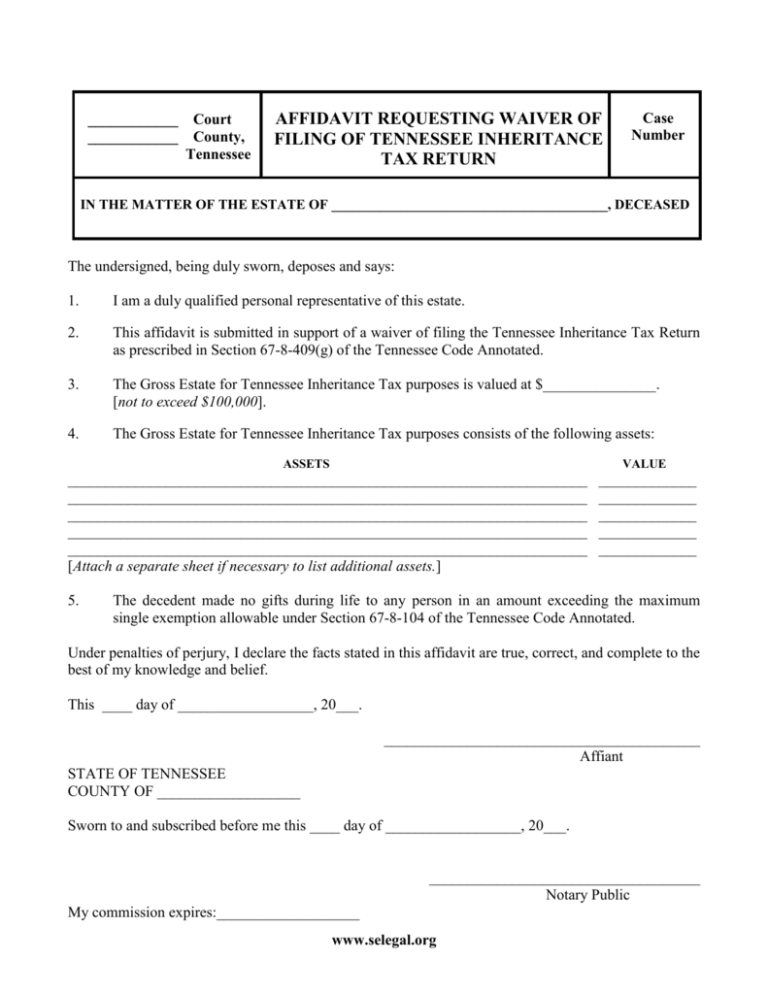

Affidavit Regarding Inheritance Tax Return

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New Irs Requirements To Request Estate Closing Letter

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

State Death Tax Is A Killer The Heritage Foundation

Calculating Inheritance Tax Laws Com

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center